Understanding your credit score is crucial for financial success. However, knowing how different financial decisions might impact that score can be equally important. Credit Karma offers a powerful tool that helps consumers make informed decisions about their credit health. According to financial experts at Communal Business, utilizing credit simulation tools has become an essential part of modern financial planning.

Credit Karma’s simulator provides users with valuable insights into how various financial actions might affect their credit scores. This tool allows you to test different scenarios before making actual changes to your credit profile. Whether you’re considering paying off debt, opening new accounts, or making other credit-related decisions, the simulator can help you understand potential outcomes.

The credit score simulator credit karma offers provides realistic projections based on your current credit profile. These projections help you make strategic decisions that align with your financial goals. Additionally, the tool considers multiple factors that influence credit scores, making it a comprehensive resource for credit improvement.

What Is Credit Karma’s Credit Score Simulator?

Credit Karma’s credit score simulator is a free tool that predicts how certain financial actions might impact your credit score. The simulator uses your existing credit profile data to generate realistic scenarios. This predictive tool considers factors such as payment history, credit utilization, account age, and credit mix.

The simulator works by analyzing your current credit report information. It then applies various changes to see how they might affect your score over time. However, it’s important to understand that these are estimates, not guarantees. Real credit score changes depend on numerous variables that can fluctuate.

The tool covers several common scenarios that consumers frequently encounter. These include paying off credit card balances, opening new credit accounts, and closing existing accounts. Furthermore, it can show the potential impact of missed payments or increased credit utilization.

How to Access and Use the Credit Score Simulator

Getting started with Credit Karma’s simulator is straightforward. First, you need to create a free Credit Karma account if you don’t already have one. The registration process requires basic personal information and identity verification. Once your account is active, you’ll have access to your credit reports and scores.

Navigate to the simulator through the Credit Karma dashboard. The tool is typically found under the “Credit” section or may be featured prominently on your main page. The interface is user-friendly and designed for consumers without extensive financial backgrounds.

To use the simulator effectively, start by reviewing your current credit profile. Understanding your baseline score and the factors affecting it will help you make better use of the simulation features. Additionally, ensure your credit report information is accurate before running simulations.

Types of Scenarios You Can Simulate

The Credit Karma simulator covers numerous scenarios that impact credit scores. One of the most popular simulations involves paying off credit card debt. This scenario shows how reducing your credit utilization ratio might improve your score. The simulator can demonstrate both partial and complete payoff scenarios.

Opening new credit accounts is another common simulation. This scenario helps you understand how new credit inquiries and additional available credit might affect your score. However, the simulation also shows the temporary negative impact of hard credit inquiries.

Closing credit accounts represents a more complex scenario. The simulator can show how closing accounts might affect your credit utilization ratio and average account age. Therefore, you can make informed decisions about whether closing an account aligns with your credit goals.

The tool also simulates the impact of missed or late payments. This feature helps you understand the serious consequences of payment delinquencies. Additionally, it can show how long negative impacts might persist on your credit report.

Understanding Simulation Results and Limitations

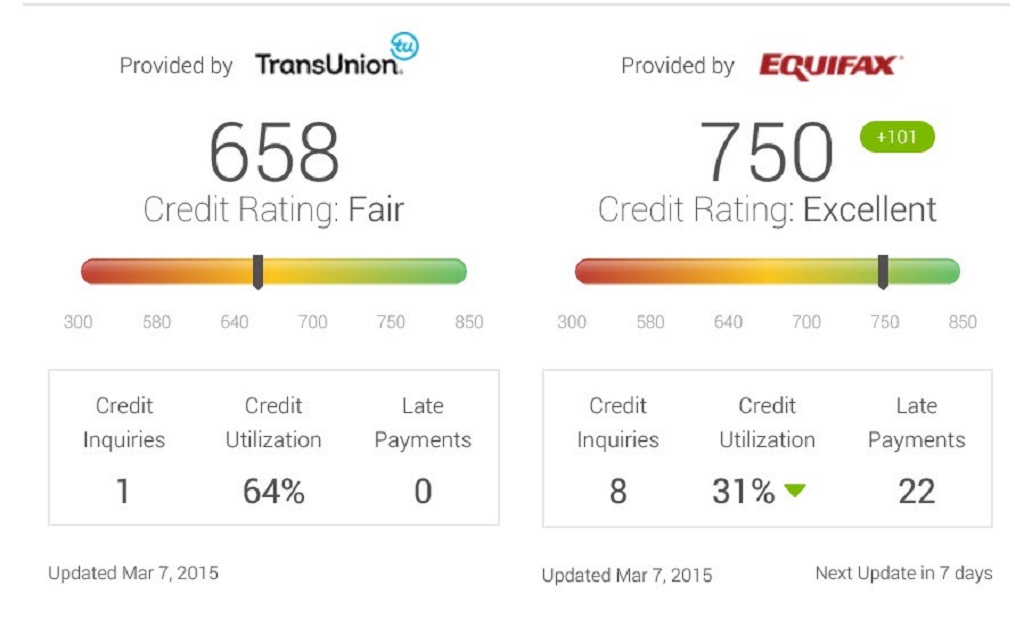

Interpreting simulation results requires understanding what the numbers mean. The simulator typically shows potential score ranges rather than exact numbers. This approach reflects the uncertainty inherent in credit scoring models. Different credit bureaus and scoring models may produce varying results.

The timeframes shown in simulations are estimates based on historical data patterns. Credit score changes don’t always occur immediately after financial actions. Some changes, like improved payment history, require consistent behavior over several months. However, other changes, like reduced credit utilization, may appear more quickly.

It’s crucial to remember that simulations are projections, not guarantees. Real-world results depend on many factors the simulator cannot account for. External economic conditions, changes in lending standards, and updates to credit scoring models can all influence actual outcomes. Therefore, use simulation results as general guidance rather than precise predictions.

Benefits of Using the Credit Score Simulator

The primary benefit of Credit Karma’s simulator is informed decision-making. Rather than making financial choices blindly, you can evaluate potential outcomes beforehand. This approach helps you prioritize actions that will have the most positive impact on your credit score.

The simulator also helps with goal setting and financial planning. You can test different strategies to see which might help you reach target credit scores fastest. This information is particularly valuable when preparing for major purchases like homes or cars.

Additionally, the tool provides educational value by demonstrating how credit scoring works. Many consumers don’t fully understand the relative importance of different credit factors. The simulator makes these relationships clearer through interactive examples.

Best Practices for Maximizing Simulator Value

To get the most from Credit Karma’s simulator, start with realistic scenarios based on your actual financial situation. Don’t just test extreme scenarios that you couldn’t realistically implement. Instead, focus on changes you can actually make within your budget and circumstances.

Run multiple scenarios to compare different strategies. For example, compare the impact of paying off high-interest debt versus spreading payments across multiple accounts. This comparison helps you identify the most effective approaches for your specific situation.

Keep track of your simulation results and the assumptions behind them. Document which scenarios produced the most favorable outcomes and the timeframes involved. However, remember to update your simulations as your financial situation changes.

Common Mistakes to Avoid

One common mistake is treating simulation results as exact predictions. The credit scoring system is complex, and many variables can influence real outcomes. Additionally, different credit scoring models may weight factors differently than Credit Karma’s simulator assumes.

Another mistake is focusing solely on quick fixes rather than long-term credit health. While the simulator can show dramatic short-term improvements from certain actions, sustainable credit improvement requires consistent good habits. Therefore, balance quick wins with strategies that support long-term credit health.

Don’t ignore the broader context of your financial situation when interpreting results. A higher credit score is valuable, but not at the expense of overall financial stability. Make sure any actions you take based on simulations align with your comprehensive financial plan.

Integrating Simulator Insights into Your Credit Strategy

Use simulation results to create a prioritized action plan for credit improvement. Start with actions that provide the biggest positive impact with the least risk or cost. However, don’t attempt to implement too many changes simultaneously, as this can create confusion about which actions produced specific results.

Monitor your actual credit score changes against simulation predictions. This comparison helps you understand how well the simulator works for your specific situation. Additionally, it can reveal factors that might be affecting your credit that weren’t considered in the simulations.

Adjust your strategy based on real results and changing circumstances. The simulator is most valuable as an ongoing tool rather than a one-time resource. Regular use helps you stay informed about how different decisions might impact your credit health.

Read More Also: Cryptocurrencies and Blockchain

Conclusion

Credit Karma’s credit score simulator serves as a valuable tool for anyone serious about improving their credit health. By providing realistic projections of how various financial actions might impact credit scores, the simulator enables informed decision-making. However, users must understand the tool’s limitations and use results as guidance rather than guarantees.

The simulator works best when combined with consistent good credit habits and regular monitoring. While it can show the potential impact of different strategies, real credit improvement requires patience and persistent effort. Therefore, use the simulator to inform your approach, but focus on building sustainable financial habits that support long-term credit health.

Remember that credit improvement is a marathon, not a sprint. The simulator can help you choose the best path forward, but reaching your credit goals requires time and consistent effort. Additionally, staying informed about credit best practices will help you maintain good credit health once you achieve your target scores.

Read More Also: Can Biotechnology Help Us Combat Climate Change

Frequently Asked Questions

How accurate is Credit Karma’s credit score simulator?

The simulator provides reasonable estimates based on historical data patterns, but results are projections, not guarantees. Actual credit score changes depend on numerous factors that can vary between individuals and over time.

Can I use the simulator multiple times with different scenarios?

Yes, you can run unlimited simulations with various scenarios. This feature allows you to compare different strategies and choose the approach that best fits your financial situation and goals.

How often should I use the credit score simulator?

Use the simulator whenever you’re considering significant financial changes that might affect your credit. Additionally, periodic use can help you stay informed about potential improvement strategies as your financial situation evolves.

Does using the simulator affect my credit score?

No, using Credit Karma’s simulator has no impact on your credit score. The tool only analyzes your existing credit data to generate projections; it doesn’t perform credit inquiries or report any information to credit bureaus.

What should I do if simulation results don’t match my actual score changes?

If results differ significantly from projections, review your credit reports for changes not considered in the simulation. Additionally, remember that different credit scoring models may weight factors differently than the simulator assumes.